My Surveyor Local explains Energy Performance Certificates (EPCs) and their relationship to property surveys. Understanding EPC ratings helps buyers assess running costs, identify improvement opportunities, and comply with rental regulations if letting the property.

What Is an Energy Performance Certificate?

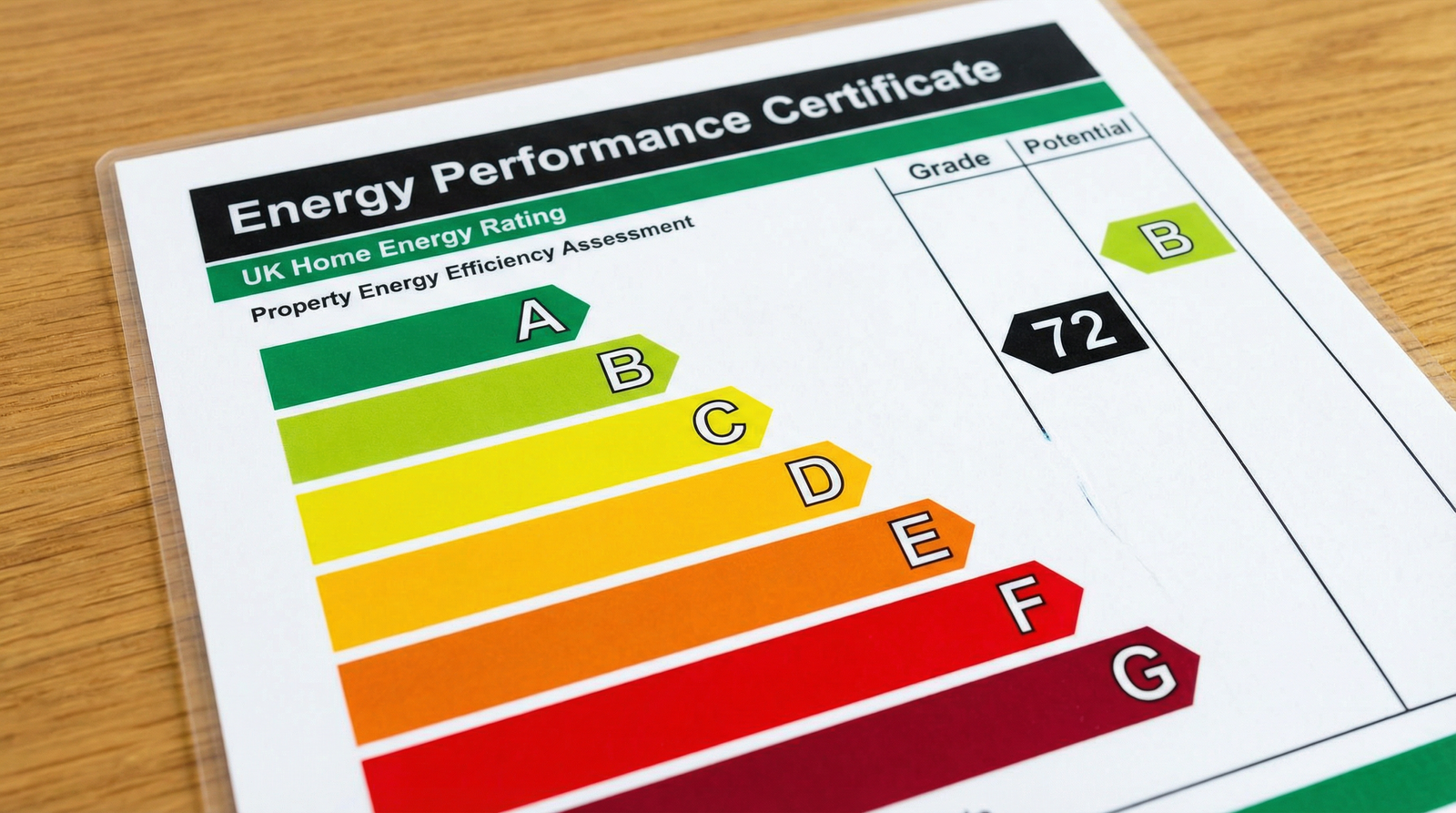

An Energy Performance Certificate (EPC) rates property energy efficiency on a scale from A (most efficient) to G (least efficient). EPCs are legally required when selling or renting properties in the UK, providing potential buyers and tenants with information about energy costs and environmental impact.

EPCs are valid for 10 years and must be commissioned before marketing properties for sale or rent. The certificate shows current energy efficiency, potential rating after improvements, and estimated annual energy costs. It also recommends improvements to increase efficiency and reduce bills.

Understanding EPC Ratings

The rating scale works as follows:

A-B (92-100 and 81-91): Very energy efficient properties with low running costs. These properties typically have excellent insulation, modern heating systems, renewable energy sources, and high-performance windows. Properties achieving these ratings are rare in the existing housing stock but increasingly common in new builds.

C-D (69-80 and 55-68): Reasonably efficient properties with moderate energy costs. Most modern properties achieve C or D ratings. These properties have adequate insulation and reasonably efficient heating but could benefit from improvements. The government aims for all rental properties to achieve at least EPC C by 2025.

E-F (39-54 and 21-38): Below average efficiency with higher energy costs. Many older properties fall into these categories. Significant improvements are usually needed to reduce bills and improve comfort. Properties rated E can still be rented currently, but this will change as regulations tighten.

G (1-20): Very poor energy efficiency with high running costs. Properties in this category typically have no insulation, single glazing, and inefficient heating. Since 2018, landlords cannot let properties rated below E without exemptions. Significant investment is required to make these properties lettable or comfortable.

What EPCs Assess

EPC assessors evaluate multiple factors affecting energy efficiency:

Insulation: Loft insulation depth and type, wall insulation (cavity wall or solid wall), floor insulation, and overall thermal performance significantly impact ratings.

Heating Systems: Boiler age and efficiency, heating controls (thermostats, programmers), radiator effectiveness, and hot water cylinder insulation all contribute to the rating.

Windows and Doors: Single, double, or triple glazing, frame materials, and door insulation affect heat loss and therefore energy efficiency.

Lighting: The proportion of low-energy lighting (LED or CFL bulbs) versus traditional incandescent bulbs impacts the rating, though less significantly than heating and insulation.

Renewable Energy: Solar panels, solar water heating, heat pumps, or other renewable technologies significantly improve EPC ratings and reduce running costs.

EPCs vs Property Surveys

EPCs and property surveys serve different purposes:

EPCs: Focus solely on energy efficiency and running costs. They don't assess structural condition, defects, or maintenance issues. EPCs are standardized assessments taking 45-90 minutes and cost £60-£120.

Property Surveys: Comprehensive assessments of property condition, structural integrity, and defects. Surveys identify problems requiring repair and provide advice on maintenance but don't specifically assess energy efficiency beyond noting obvious issues like lack of insulation visible in roof spaces.

Both documents provide valuable information for different purposes. My Surveyor Local recommends obtaining both EPCs and comprehensive surveys when buying property to understand both energy costs and structural condition.

How EPCs Affect Property Purchases

EPC ratings influence buying decisions in several ways:

Running Costs: Properties with poor ratings cost significantly more to heat and power. A property rated G might cost £2,500-£3,000 annually for energy, while one rated C costs £800-£1,200. Over time, these differences add up substantially.

Mortgage Availability: Some lenders offer preferential rates for energy-efficient properties. Green mortgages with lower interest rates or higher loan-to-value ratios are increasingly available for properties rated A or B.

Future-Proofing: As energy efficiency regulations tighten, properties with poor ratings may become harder to sell or let. Investing in energy-efficient properties or those easy to improve protects long-term value.

Improvement Costs: Factor EPC recommendations into budgets. Improving a property from E to C might cost £5,000-£15,000 depending on size and current condition. Consider these costs when negotiating purchase prices.

Rental Potential: If you're buying to let, minimum EPC ratings apply. Properties below E cannot be let (with some exemptions). From 2025, the minimum will increase to C for new tenancies, affecting many rental properties.

Improving Your EPC Rating

Common improvements recommended in EPCs include:

Insulation Improvements

Loft insulation is the most cost-effective improvement. Increasing loft insulation to 270mm costs £300-£500 but significantly improves ratings and comfort. Cavity wall insulation costs £500-£1,500 depending on property size and provides excellent returns. Solid wall insulation (internal or external) is more expensive (£4,000-£14,000) but dramatically improves poorly-rated properties.

Heating System Upgrades

Replacing old boilers with modern condensing boilers improves efficiency from 60-70% to 90%+. New boilers cost £2,000-£3,500 installed but reduce bills by 25-35%. Installing heating controls (programmable thermostats, thermostatic radiator valves) costs £200-£500 and provides better temperature management.

Window Replacement

Upgrading single glazing to double glazing improves ratings significantly. Costs vary from £400-£1,000 per window depending on size and specification. While expensive, new windows improve comfort, reduce noise, and add value.

LED Lighting

Replacing traditional bulbs with LEDs is inexpensive (£50-£100 for a whole house) and improves ratings slightly while reducing electricity costs by 80-90% for lighting.

Renewable Energy

Solar panels significantly boost EPC ratings while generating free electricity. Installation costs £5,000-£8,000 but provides 20-25 years of free power after payback periods of 10-15 years. Solar thermal hot water systems cost £4,000-£6,000 and reduce water heating costs by 40-70%.

EPC Regulations for Rental Properties

Landlords must be aware of minimum energy efficiency standards:

Current Rules: Since April 2018, properties must have minimum EPC ratings of E to be let. Properties rated F or G cannot be let unless registered exemptions apply (for example, if improvements aren't cost-effective or tenants refuse access for works).

Future Changes: From April 2025, new tenancies will require minimum EPC ratings of C. From April 2028, this will apply to all existing tenancies. This affects approximately 2.2 million rental properties currently rated D or below.

Penalties: Letting properties below minimum standards incurs fines up to £5,000 per property per breach. Local authorities can enforce these penalties, making compliance essential.

Exemptions: Limited exemptions exist where improvements aren't cost-effective, properties are listed buildings where changes require consent, or tenants refuse access. Exemptions last 5 years and must be registered on the national PRS Exemptions Register.

Getting an EPC

When buying property, sellers should provide EPCs before you view. If buying property without EPCs, you can commission them yourself:

Find Accredited Assessors: Search the official EPC register or contact My Surveyor Local for recommendations. Only accredited assessors can produce legally valid EPCs.

Costs: EPCs typically cost £60-£120 depending on property size and location. This is a small cost compared to survey fees but provides valuable information.

Timing: Assessments take 45-90 minutes. You'll receive certificates within 48 hours, registered on the national database for 10 years.

Access: Assessors need access to all rooms including lofts (where safe) and boiler cupboards to assess properly.

Limitations of EPCs

While useful, EPCs have limitations:

Standard Assumptions: EPCs use standardized assumptions about occupancy, heating patterns, and usage that may not reflect your actual lifestyle. Your real energy costs might differ significantly from EPC estimates.

Focus on Fabric: EPCs assess building fabric and systems but don't consider occupant behavior, which significantly affects actual energy use. A property rated C with wasteful occupants might cost more to run than one rated E with energy-conscious occupants.

Variations Between Assessors: Different assessors might give the same property slightly different ratings due to interpretation differences or assessment timing (ratings consider heating season, so summer assessments might differ from winter ones).

Not Condition Assessments: EPCs don't identify defects, maintenance issues, or problems requiring repair. They complement but don't replace property surveys.

Using EPCs in Negotiations

Low EPC ratings provide negotiating opportunities:

Calculate Improvement Costs: Get quotes for work recommended in EPCs. Use these figures to negotiate purchase price reductions.

Consider Running Costs: Properties with poor ratings cost more annually to run. Factor lifetime energy costs into your offer prices.

Rental Potential: If buying to let properties rated D or E, negotiate discounts reflecting costs to achieve C ratings before 2025 deadlines.

Future Sales: Properties hard to heat or with poor ratings may be harder to sell. Negotiate prices reflecting this reduced demand.

Green Mortgages and Incentives

Several schemes reward energy-efficient properties:

Green Mortgages: Lenders offer preferential rates for properties rated A or B, or for buyers undertaking energy efficiency improvements. Rate reductions of 0.1-0.5% are typical, saving hundreds annually.

Government Grants: Various schemes provide grants for insulation, heating upgrades, and renewable energy installations. Eligibility varies by location and circumstances.

Energy Company Obligations: Energy suppliers fund efficiency improvements for qualifying households through ECO schemes. Check eligibility for free or subsidized improvements.

Conclusion

Energy Performance Certificates provide valuable information about property running costs and improvement opportunities. While they don't replace comprehensive property surveys, EPCs help buyers understand long-term costs and plan energy efficiency investments.

My Surveyor Local recommends considering both EPCs and property surveys when buying. Together, they provide complete pictures of property condition and efficiency, helping you make fully informed purchase decisions.

Need a Property Survey?

Contact My Surveyor Local to arrange your comprehensive property survey. We'll help you understand both structural condition and energy efficiency.

Get Your Free Quote